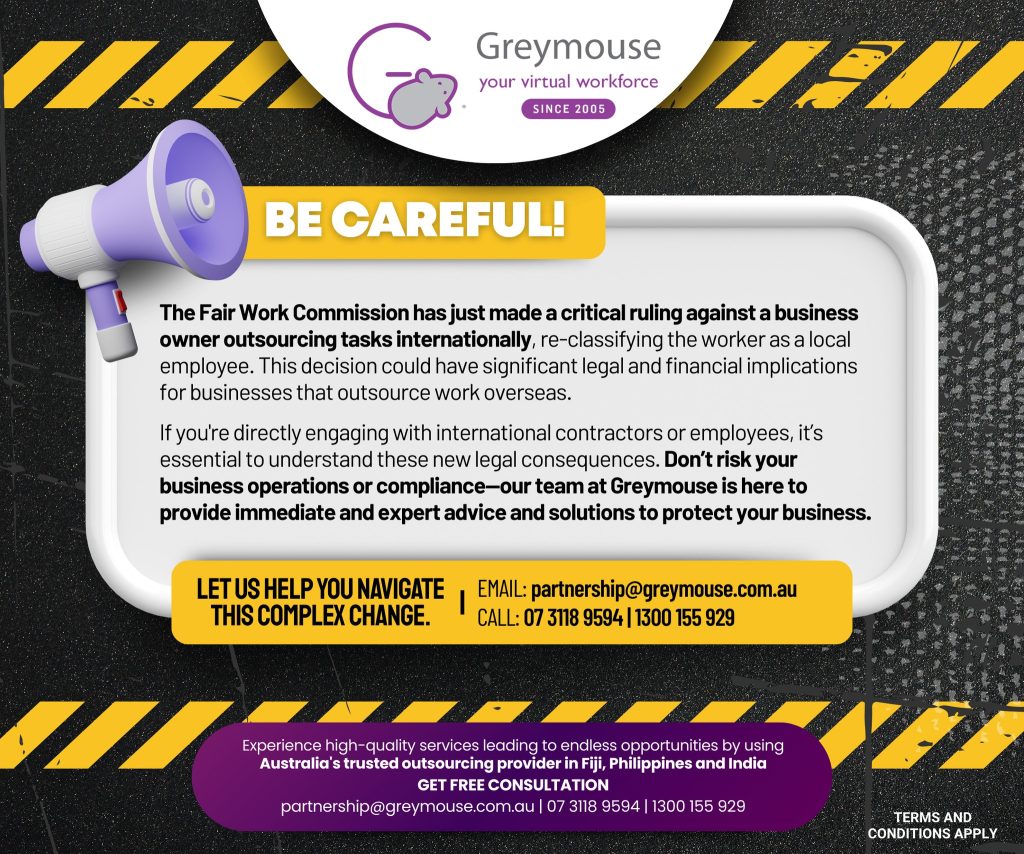

Outsourcing has long been a powerful strategy for Australian companies, that allows them to scale operations, reduce overheads, and access specialised global talent. However, a recent ruling from the Fair Work Commission has introduced a new layer of complexity for businesses employing international contractors. This ruling reclassifies international workers as local employees, introducing new legal and financial obligations for Australian businesses employing overseas contractors.

This development has left many business owners wondering: What does this mean for my company? How do I ensure compliance while benefiting from outsourcing?

Secure Your Business and Comply with Fair Work’s New Overseas Employee Standards

Published by: Greymouse Marketing | 15 November, 2024

“Adapting to change is crucial for growth. While new regulations may add complexity, they also present an opportunity to strengthen and future-proof your business. “

Benefits of Partnering with Greymouse

Working with Greymouse means peace of mind. We handle the complexities of international outsourcing, so you can focus on running your business. By partnering with us, you’ll gain:

• Access to a reliable and skilled international workforce that remains fully compliant with legal requirements.

• Protection for your business operations from potential fines, legal action, and reputational damage.

• Guidance from a team of experts who are dedicated to helping Australian businesses succeed in an evolving regulatory landscape.

Take Action to Secure Your Business

The recent Fair Work Commission ruling serves as a reminder that the business landscape is constantly changing. Adapting to these changes is essential for any company that wants to maintain compliance, protect its operations, and continue growing.

Greymouse is here to help you adjust to this new environment with ease. Contact us today for a free consultation, and let us help you understand the best options for your business.

Don’t wait until compliance becomes a problem. Take proactive steps with Greymouse by your side.